How to Get the Deed to Your House: A Comprehensive Guide Estate Planning Learning Center

Table Of Content

- The Bottom Line: The Deed To Your House Is Proof Of Legal Ownership

- Estate planning strategies by asset

- See Property Deed Pricing by State

- How Quiet Title Actions Evaluate The True Ownership Of A Property

- Update Your Estate Plan to Include the Deed to Your House

- How to Get a Farm Loan with No Down Payment: Your Ultimate Guide to Zero-Upfront Financing

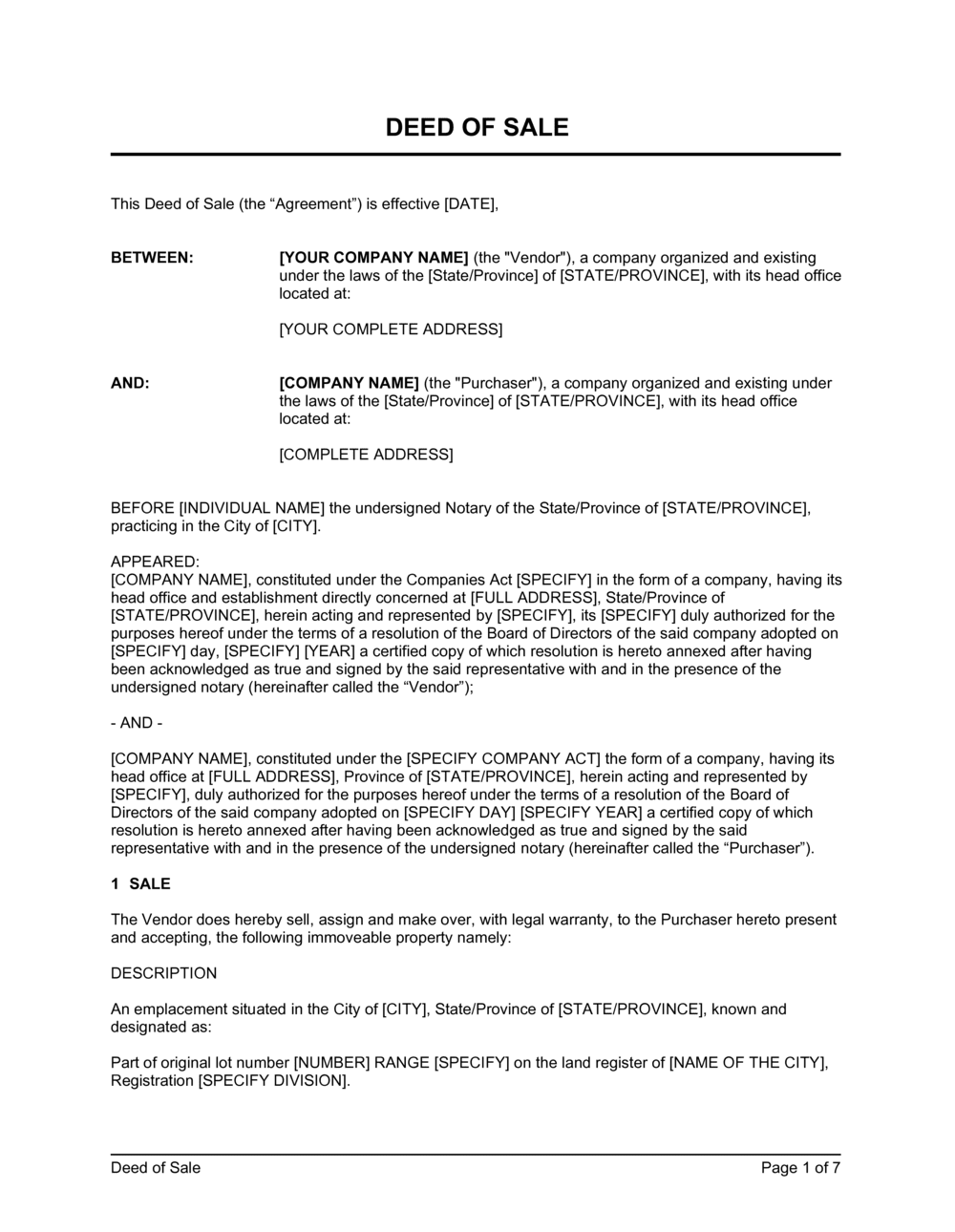

In Texas, the property is legally transferred when the grantee accepts the signed deed. However, recording the deed lets everyone know who owns the property. Recording every deed also clarifies the chain of ownership, which helps assure future buyers that you have the right to sell the property. It can be difficult to sell property if you cannot show clear title. You can search for property records and property ownership information online, in person, or over the phone with a 311 representative.

The Bottom Line: The Deed To Your House Is Proof Of Legal Ownership

Let’s more closely examine some of the most common types of special purpose deeds. Let’s take a closer look at what a house deed is, the different types of house deeds and which deed you may encounter when buying a home. Yes, if you’ve legally changed your name due to marriage, divorce, or any other reason, it’s a good idea to update your property deed to reflect this change. This ensures no complications arise during future transactions. It’s advisable to review your property deed every few years or after any significant changes to your property, such as renovations or boundary alterations. Moreover, always check the deed before any property-related transactions, like selling or mortgaging the house.

Estate planning strategies by asset

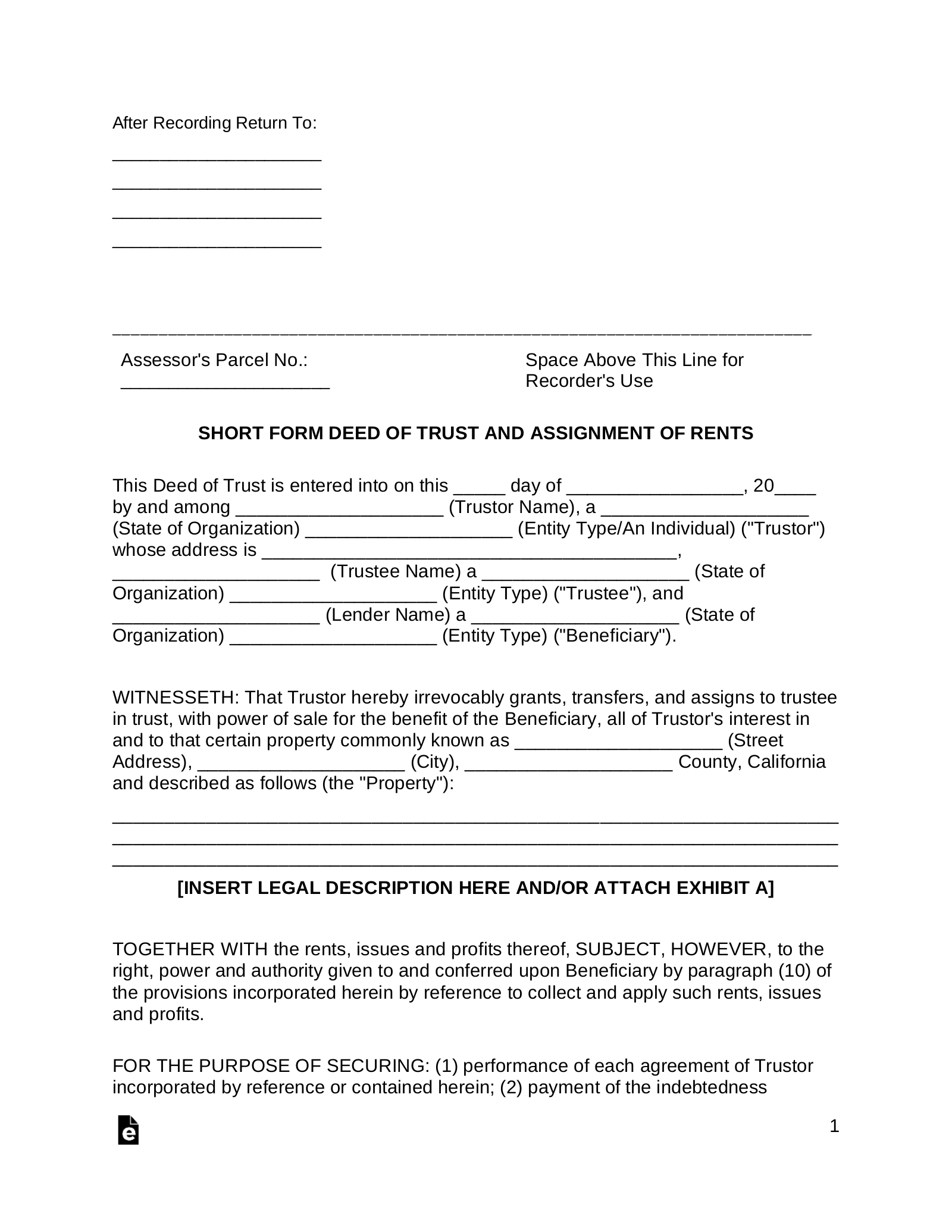

During that time, they are responsible for maintenance, taxes, and other aspects of ownership. A divorce decree may say which spouse should get the property, but the decree does not actually transfer the property. The deed should include terms to make sure that the transfer honors the conditions in the divorce decree. For example, a deed of trust to secure assumption may be used to help divide marital real estate when there is a mortgage.

See Property Deed Pricing by State

Again, this type of deed makes no warranties regarding title. If this conflict grows into a lawsuit, a judge will need to decide whose rights (or title) will be enforced. When you buy a home, you want to buy one that doesn’t come with costly baggage. Understanding who truly owns your home and protecting yourself with title insurance can give you peace of mind and help you avoid a financially ruinous title disaster. The methods of holding title mentioned above pertain to individuals, but it’s also possible for other entities to hold title as well.

Maricopa County homeowners: Watch out for this property-deed scam - The Arizona Republic

Maricopa County homeowners: Watch out for this property-deed scam.

Posted: Tue, 21 Mar 2017 07:00:00 GMT [source]

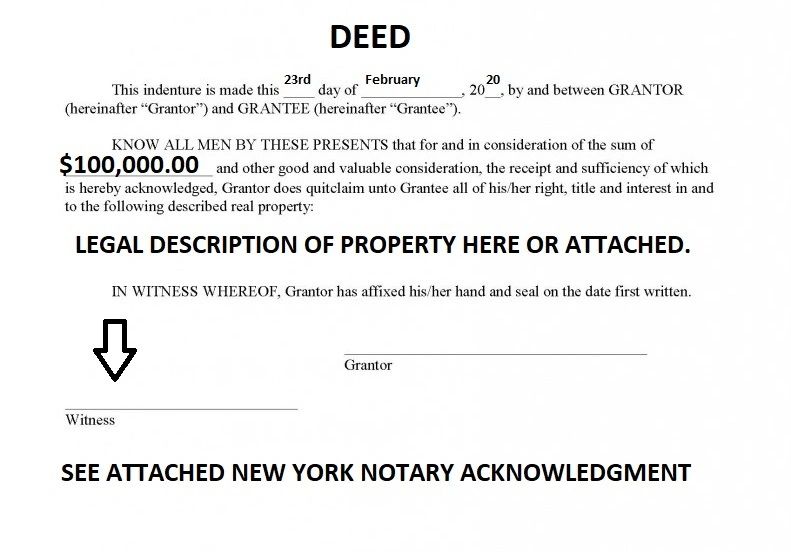

If they sold the house, it would be taxed based on its value at the time of the previous owner's death. Many types of special purpose deeds exist to meet different legal needs. These deeds may fall into the general, special warranty, no warranty, or quitclaim deed categories. All deeds must meet the basic legal requirements for a deed unless a statute makes an exception.

In Texas, deeds often include language similar to “in exchange for $10.00 and other valuable consideration,” even though real estate usually sells for far more than $10.00. The deed can also reference a description found elsewhere, so long as it is in writing and exists when the deed is drafted. For example, a deed could reference a public survey, property tax documents, or even the most recent deed to the property.

There are a few different ways homeowners can hold title to a property. These different methods can change how ownership interest is divided among co-owners and who that interest will be passed onto when an owner dies. Essentially, the deed is the physical document that proves you hold title to your home. It’s also important to understand the way you hold title on your property. Co-owners, liens and easements can all limit what you’re able to do as an individual with your property. You might think that the person selling the home is the one who legally owns it, and that when they sell it to you, you’ll be the legal owner.

Spring House Hunt: Women home buyers are still facing 1950s gender bias - Boston.com

Spring House Hunt: Women home buyers are still facing 1950s gender bias.

Posted: Wed, 06 Apr 2022 07:00:00 GMT [source]

There are many types of deeds used to transfer property, depending on the situation. The deed history of the home you’re buying will show up in a title search. It is crucial for homeowners to familiarize themselves not only with the importance of house deeds and property titles, but also with the process of finding and updating them. The original property deeds are typically held by real estate lawyers who acted when the property was last sold. Also, your mortgage provider may retain the deeds to your property if you have any mortgage on the property. The process to get such alterations made can vary from state to state, so you may need to do some research.

From here, you may be able to look up your property, locate the deed, and download a copy of your deed onto the computer. A deed of trust to secure assumption is used to grant property rights when there is an existing mortgage or similar home finance loan. It requires the grantee to make house payments while giving the grantor, who is not the lender, the right to enforce those payments. It does not remove the mortgage or lessen the lender’s claim.

First and foremost, it proves that you are the legal owner of a property, and thus have the right to take certain actions. Examples include taking out a new mortgage on the property or selling the property. If you were to buy a home under the table and never have a deed recorded, you would not be the title holder in the eyes of the law. Therefore, you wouldn’t have access to certain rights or financial tools that would otherwise be at your disposal. A deed is a legal document that transfers ownership of real property.

Some states may also provide this service through a central registry. Fees and requirements may vary, so it’s essential to check with your specific county or state. In most cases, the buyer does not receive the actual deed at closing; instead, they receive various closing documents.

With these tips in your arsenal, you’re not only poised for a hassle-free title transfer but also assured of secure homeownership. If you weren’t able to find your deed online, then your next step is to contact your County Recorder’s Office. Here, you can speak with a customer service representative and request help locating and obtaining a copy of your deed. If you were lucky, you may have already located your deed and won’t need the rest of these steps. However, in some cases, a simple web search may not yield any results. This is especially true if your county doesn’t provide electronic records, or if the deed is older and has been archived.

Comments

Post a Comment