View Real Estate Records

Table Of Content

In addition, several states have estate tax exemption limits far below the federal level. If the value of the home exceeds that limit, and there aren't other assets from the estate available to pay the taxes, the heir may have insufficient funds to pay the state estate tax bill. That could force a sale of the home or force the heir to seek financing options to pay the bill.

Less Common Ways To Hold Title

Get matched with a lender that will work for your financial situation. When you die, the assets in your trust will be distributed according to your instructions without having to go through probate. Apply online for expert recommendations with real interest rates and payments. If that heir can prove that they’re the rightful owner of the property, you could lose your home.

Deed Of Reconveyance: Definition, Process And FAQs

Or they might be prohibited from painting their house certain colors. Unfortunately for Jane, Bob did not know about Jane’s purchase and Jane’s deed is not in the public record. That means Bob had no actual or constructive notice of Jane’s claim on the property when he bought it. Bob gets to keep the property because he is a good faith purchaser. Jane may sue Gary for damages, but she cannot take the property from Bob.

How To Get a Property Deed – Step by Step

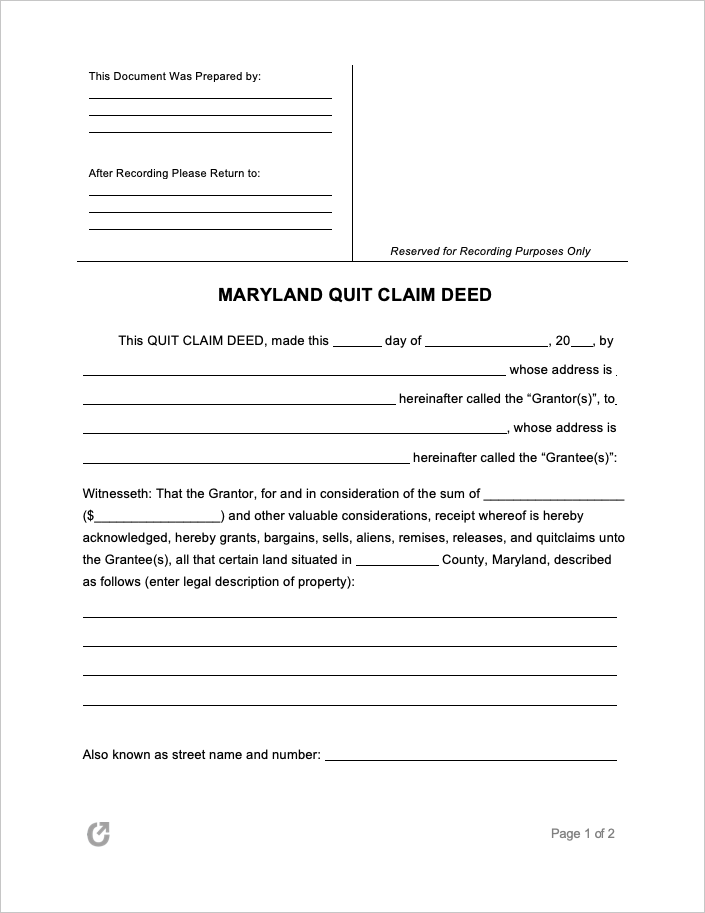

A deed without warranties only transfers title to the property, with no protections for the grantee. It makes no promises and offers no legal recourse if there is a problem. It allows the grantor to give up all ownership, with no responsibility toward the property or the grantee in the future.

Budgeting for Additional Costs like Title Insurance

Replacing important documents isn’t hard if you know where to go - Honolulu Star-Advertiser

Replacing important documents isn’t hard if you know where to go.

Posted: Tue, 17 Aug 2021 07:00:00 GMT [source]

In her spare time, Miranda enjoys traveling, actively engages in the entrepreneurial community, and savors a perfectly brewed cup of coffee. If you’re unsure if you need to make changes to your house deed or need guidance on how to start the process, a real estate attorney is likely the best person to help you. If you discover errors on your deed, it’s crucial to address them promptly. Consult with a real estate attorney or title company to get guidance on rectifying the mistakes, which usually involves recording a corrective deed. In some cases, this will take you to the website of your local County Recorder or equivalent. If you’re lucky, your county might even provide a self-service official records search site.

Get Help with a Property Deed

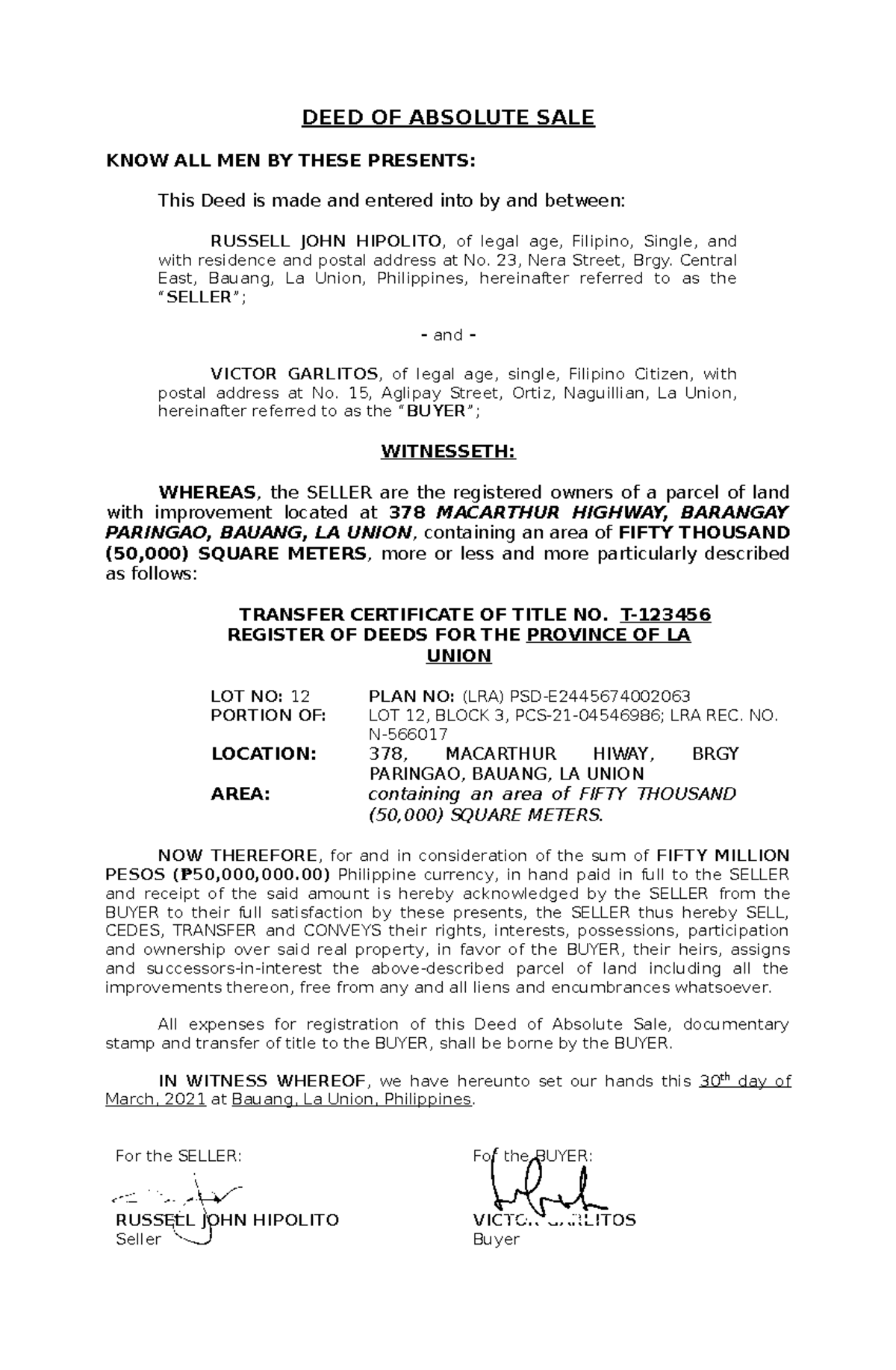

Others think that if they’ve been living in a house for years, the deed must surely be in their name. The house deed is your legal proof of ownership, and without it, things can get complicated, especially if you’re thinking of selling your house or settling estate matters. Not only do they provide proof of ownership, but they are also a key legal instrument used to transfer property ownership from one party to another. Because different property transactions have different circumstances, there are a number of house deed types to choose from. Having a house deed means that you’re the rightful owner who holds title to your house.

Remember that a house title refers to the legal ownership of a property. More commonly, a homeowner will, knowingly or not, try to sell a home that has some type of lien on it. Maybe they have property taxes they never paid or a contractor performed some work on the house and was never paid for the job. If the sale goes through, the new owner becomes legally responsible for those debts.

Understanding Property Taxes and Their Implications

Consult with an attorney, if necessary, to ensure the accuracy and validity of your estate plan. By keeping your estate plan up-to-date, you can safeguard your property and provide peace of mind for both you and your family. If the online search doesn’t yield any results or if your county doesn’t offer electronic records, your next step is to contact your County Recorder’s Office directly. Alternatively, you can pay them a visit in person, speak with a customer service representative, and request assistance in locating and obtaining a copy of your deed. A deed to a house represents a legal document that establishes proof of ownership for a property. It serves as a tool to transfer property interest from one party to another.

Homeowner set up a living trust and signed a quitclaim deed; but now he wants to sell his home - Chicago Tribune

Homeowner set up a living trust and signed a quitclaim deed; but now he wants to sell his home.

Posted: Thu, 07 Mar 2019 08:00:00 GMT [source]

Steps To Buying A House

In most states, the grantor will be required to get the document notarized. The grantor is also responsible for ensuring the deed is delivered to the grantee. You’ll also need an owner’s title policy to protect your interests. The buyer typically pays these costs as part of their closing costs.

Title theft is rare, but the implications should keep every property owner vigilant. A deed with life estate reserved allows the grantor to keep using the property as long as they are alive. A partition deed breaks up jointly owned property and assigns a portion, or "partition," to each co-owner. Note that there are different rules for married and unmarried co-owners, as married couples already have certain survivorship rights.

To simplify further, imagine the deed as a gift-wrapping paper, and the title as the actual gift inside. The wrapping (deed) serves its purpose once and is then discarded, while the gift (title) remains. Legal instruments such as deeds to houses can be complicated, but luckily, the process of getting the deed to your house isn’t.

Either way, there is a specific process that must be followed to make changes to your deed. A tax deed is used when a property is sold by a municipality due to foreclosure for unpaid property taxes. The difference between house deed and house title can cause confusion. When a sole owner dies, who takes over ownership of the home depends on whether they had a will. If they did, the property will be passed to the heirs designated in the will. If they didn’t have a will, the home will be transferred according to state law.

In other words, the grantor is the seller or giver of the property. The Department of Finance (DOF) posts statistical data about City properties online. The Rolling Sales File sorts sales information into several categories for buyers and sellers. The files include neighborhood, building type, square footage, and other data. You can request a certified or uncertified copy of property records dated before 1966 in person. Deeds can also sometimes need to be changed due to clerical errors or a change in ownership.

Comments

Post a Comment